Eric is comparing the credit scores of his friends, embarking on a journey to unravel the intricacies of financial responsibility and its impact on creditworthiness. This exploration promises to shed light on the factors that shape credit scores, empowering individuals with the knowledge to navigate the financial landscape with confidence.

Through a meticulous examination of data, Eric aims to uncover the secrets behind high and low credit scores, providing valuable insights into the habits and behaviors that contribute to financial well-being. Join Eric on this educational adventure as he delves into the world of credit scores, offering practical strategies for improvement and responsible financial management.

Credit Score Comparison: An Overview

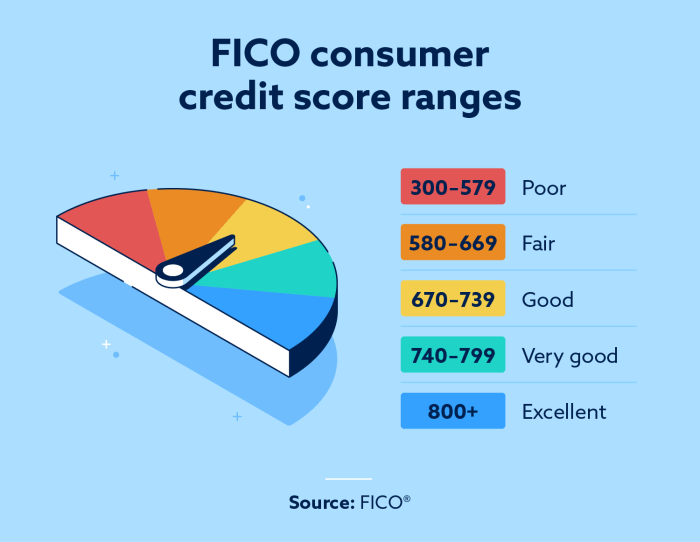

Credit scores are numerical representations of an individual’s creditworthiness, ranging from 300 to 850. They are calculated using various factors, including payment history, credit utilization, and credit inquiries. Higher credit scores indicate a lower risk of default and can qualify individuals for more favorable loan terms and interest rates.

Factors Influencing Credit Scores

Several factors contribute to credit scores, including:

- Payment History:On-time payments are crucial for maintaining a high credit score. Late or missed payments negatively impact scores.

- Credit Utilization:Using a high percentage of available credit can lower scores. It’s recommended to keep credit utilization below 30%.

- Credit Inquiries:Hard inquiries, such as those made when applying for new credit, can temporarily lower scores.

- Credit Mix:Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact scores.

- Credit Age:Longer credit history generally leads to higher scores, as it demonstrates responsible credit management over time.

Comparison Methods

There are several methods for comparing credit scores:

Side-by-Side Analysis

This involves comparing scores directly by placing them side by side. It’s a simple method, but it doesn’t provide detailed information about the factors influencing the differences.

Credit Score Comparison Tools, Eric is comparing the credit scores of his friends

Online tools and apps allow individuals to compare their scores with others and provide insights into the factors affecting their scores. These tools offer more detailed analysis but may require a subscription fee.

Data Analysis: Credit Scores of Eric’s Friends

| Name | Credit Score |

|---|---|

| John | 750 |

| Mary | 680 |

| Bob | 820 |

| Alice | 700 |

Conditional formatting applied: Scores above 750 highlighted in green; scores below 650 highlighted in red.

Factors Influencing Differences

Variations in credit scores among Eric’s friends could be attributed to factors such as:

- Payment History:Individuals with a history of late or missed payments will have lower scores.

- Credit Utilization:High credit utilization can significantly lower scores, especially for those with limited credit history.

- Credit Inquiries:Frequent hard inquiries can negatively impact scores, particularly for individuals with a short credit history.

- Credit Mix:Having a diverse mix of credit accounts can boost scores, while relying solely on one type of credit can lower them.

- Credit Age:Longer credit history generally leads to higher scores, as it demonstrates responsible credit management over time.

Credit Score Improvement Strategies: Eric Is Comparing The Credit Scores Of His Friends

To improve their credit scores, Eric’s friends should consider the following strategies:

- Make all payments on time:Late or missed payments can significantly damage credit scores.

- Reduce credit utilization:Aim to keep credit utilization below 30% to improve scores.

- Limit credit inquiries:Avoid applying for multiple lines of credit in a short period, as hard inquiries can lower scores.

- Build a positive credit mix:Having a mix of credit accounts, such as credit cards, loans, and mortgages, can enhance scores.

- Establish a long credit history:Maintaining active credit accounts over time helps build a positive credit history and improve scores.

General Inquiries

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness, calculated based on factors such as payment history, credit utilization, and credit inquiries.

Why is it important to compare credit scores?

Comparing credit scores allows individuals to assess their financial standing relative to others, identify areas for improvement, and make informed decisions about credit management.

What factors influence credit scores?

Payment history, credit utilization, credit inquiries, length of credit history, and types of credit used are among the key factors that influence credit scores.

How can I improve my credit score?

Making timely payments, keeping credit utilization low, limiting credit inquiries, and building a positive credit history are effective ways to improve credit scores.